03 June 2025

After General Electric breakup, GE Aerospace faces large opportunities

The content presented below is taken from Teal Group's

Defense and Aerospace Company Briefing

To better leverage its strength and provide improved opportunities for all its diverse holdings, the legacy company, General Electric, broke into three distinct companies: GE Healthcare, GE Vernova (power, energy and digital segments), and GE Aerospace. Following the planned spin-offs, GE Aerospace became an aviation-focused company. This occurred in the second quarter of 2024.

As part of its breakup, GE Aerospace became the name of the resulting part of the legacy company that would serve the aviation industry. It is the leader in commercial aircraft engine orders but faces growing competition from Raytheon Technologies’ Pratt & Whitney, its traditional American rival. In military engines General Electric is a strong but second place finisher in dollar-value delivered. Pratt & Whitney is the market leader.

The company has an installed base of approximately 45,000 commercial and 25,000 military engines which drives its aftermarket services business, which represents approximately 65-70% of revenue.

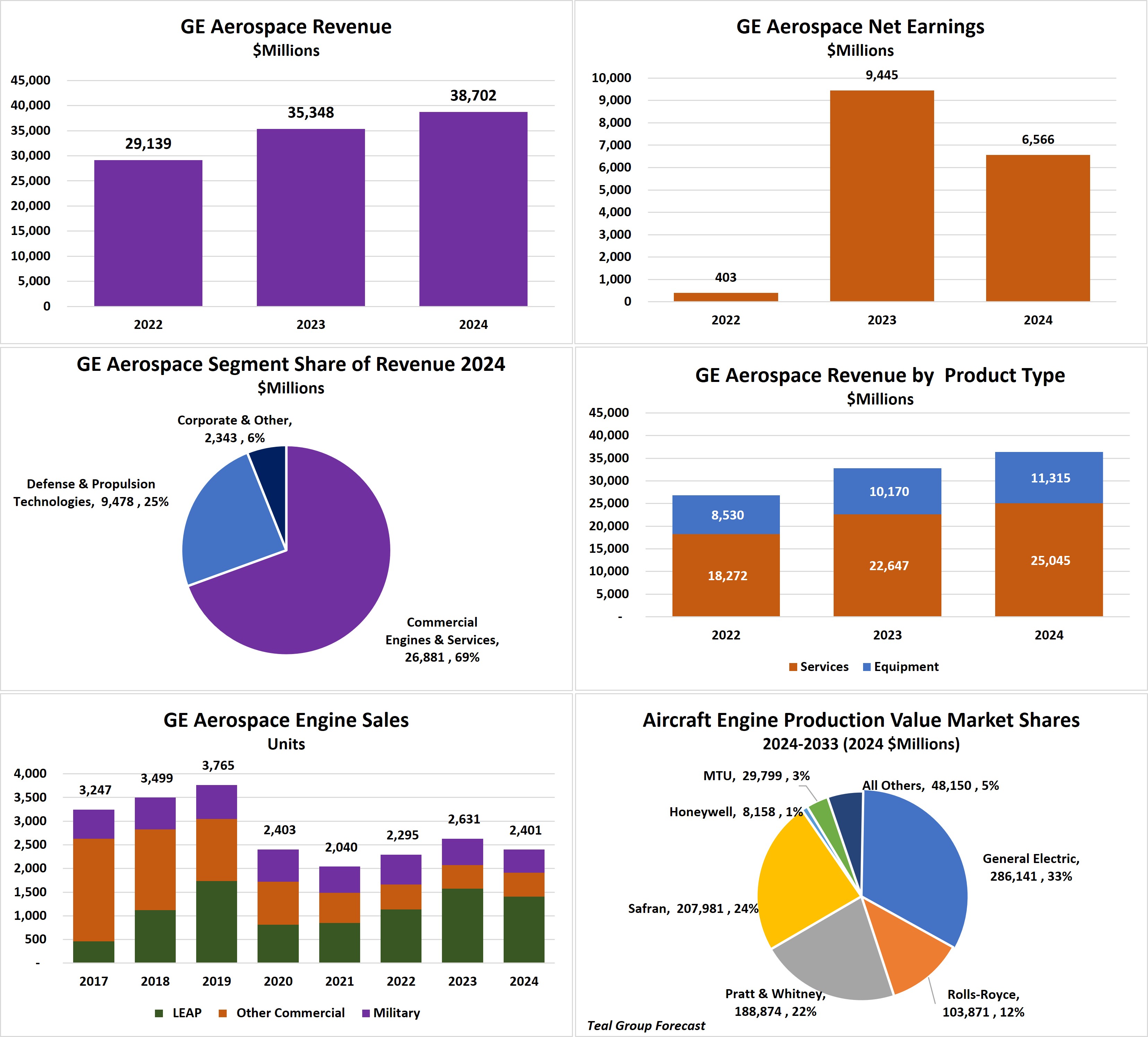

During 2019, the year prior to the onset of the pandemic, the company delivered 3,048 total commercial engines. By 2021, the number declined to less than half, 1,487 engines. Things improved in 2022 when the company delivered 1,663 commercial engines and then again in 2023 with 2,075 engines. For all of 2024, the company experienced a modest decline to 1,911 commercial engines.

In its first year of independent operation, the new GE Aerospace generated $38.7 billion in revenue in 2024, up from $35.348 in 2023, an increase of 9.5%. Due to the financial restructuring that occurred at the time that GE Aerospace was spun-out of the legacy company, results cannot be compared to earlier financial results for the GE Aviation segment.

Profit as measured by net earnings was $6.566 billion in 2024, down by 30% from the $9.445 that was recorded in 2023. This yielded a net earnings margin of 17% versus 26.7% in 2023. Much of this year-over-year change can be attributed to the operational and financial restructuring. The coming years should show more stability.

The new company operates in two business segments: Commercial Engines and Services and Defense & Propulsion Technologies. Commercial Engines and Services accounted for $26.9 billion of revenue in 2024 or 69% of the total company. This was up from $23.9 billion in 2023. Defense & Propulsion Technologies finished 2024 with $9.5 billion in revenue or 25% of the company total. This was up from $9 billion in all of 2023. The company reported that the category Corporate & Other represented the remaining 6% of total revenue in 2024.

The Defense & Aerospace Companies Briefing includes coverage of major global competitors. Each report addresses key events, strategic initiatives, segment performance, product development, contracts, partnerships, acquisitions, restructurings, finances and more.

To inquire about subscribing, visit Defense & Aerospace Company Briefing

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591