12 June 2025

Safran UPDATE Strong growth as pandemic impact fades away

The production ramp-up of commercial airliners promises to drive growth in engine deliveries and equipment as the recent pandemic fades into the past. This will be further enhanced as the 737 MAX ramps up production in response to the large undelivered inventory that must be placed with airlines. Boeing will produce 38 aircraft per month during much of 2025. That is the limit imposed by the FAA and is well below the 50 per month that Boeing had targeted.

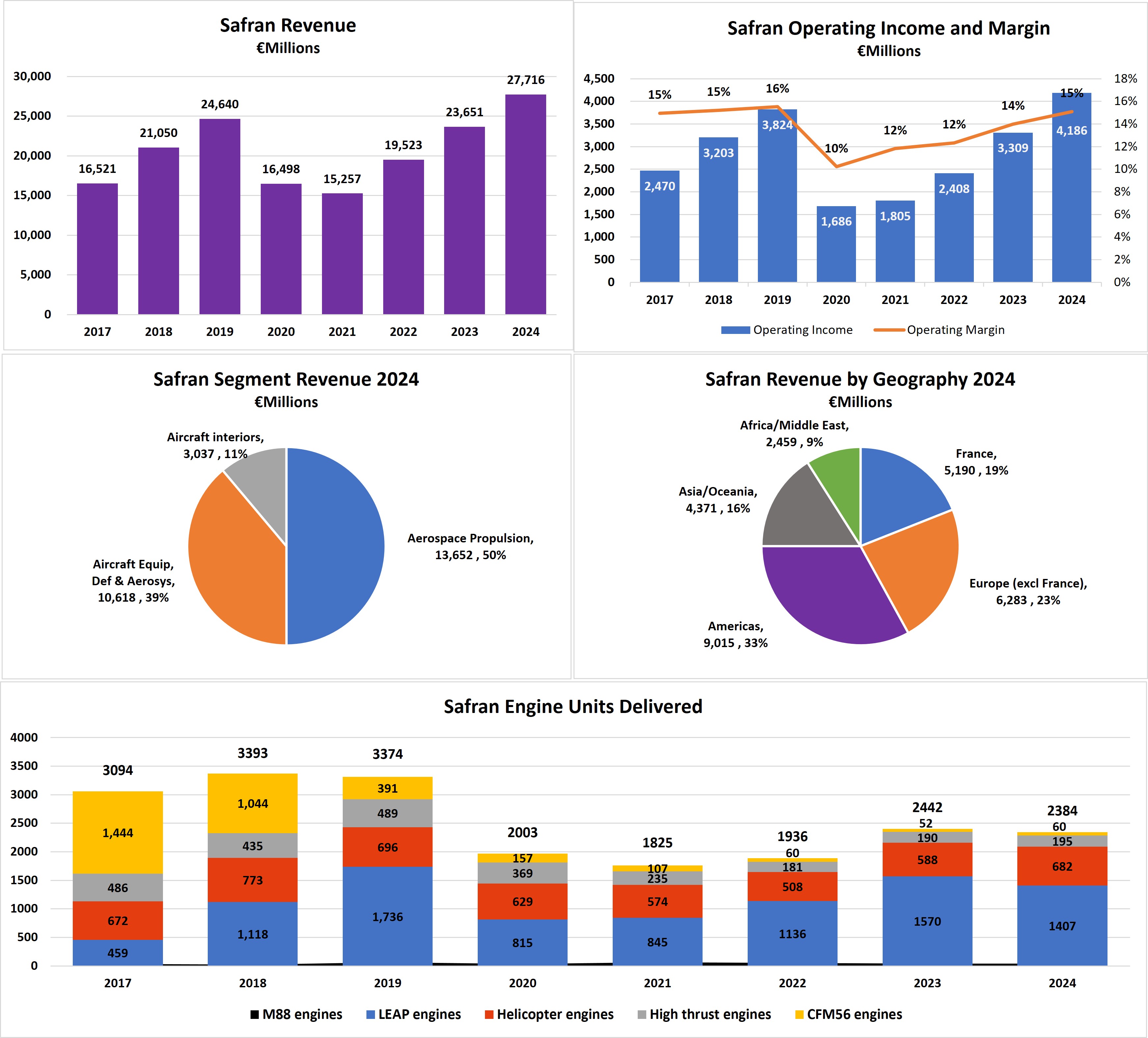

The pandemic driven decline in commercial aerospace had a dramatic impact on Safran’s operations and financial performance. But the post-pandemic rebound has been strong, as demonstrated by the 28% growth of total revenue in 2022, then 21% growth in 2023 and 17% in 2024. Management states that 2025 revenue will exceed €30 billion, a doubling of the only €15 billion in the pandemic decimated 2021.

Likewise, operating income had rebounded and moved to a new high. For all of 2024, operating income was €4.2 billion compared to €3.3 billion in 2023, a 26.5% increase. This yielded an operating margin of 15%, which is just below the 16% margin achieved in 2019.

Each of the company’s three segments contributed to the strong growth with Aerospace Propulsion leading the way. It finished 2024 at €13.7 billion of revenue, up a solid 15% from €11.9 billion in 2023. Aircraft Equipment, Defence & Aerosystems had 2024 revenue of €10.6 billion compared to €8.8 billion in 2023, a 20% boost. And Aircraft Interiors, the smallest of the three, had €3.0 billion of revenue in 2024, up 23% from €2.5 billion in 2023.

The most recent financial results (first quarter of 2025, ending March 31st) reported that quarterly revenue was up 17% from the first quarter in 2024. The company is projecting that full year revenues for 2025 will be approximately €30.5 billion, an increase of 10%.

With a commitment to invest €1 billion to expand its existing maintenance, repair and overhaul (MRO) business, Safran is looking to capitalize on the rapidly growing installed base of LEAP engines. Entering the market in 2016 and powering nearly 4,000 narrowbody aircraft, the LEAP engines are beginning to require increased maintenance services. Major overhauls typically begin about six years after entering service and then every 6-8 years thereafter. The investment strategy is to expand Safran’s MRO capabilities, allowing it to support the anticipated ramp-up in demand for LEAP after-sales services in the coming years.

Acquisitions continue to be a priority with a total of at least nine taking place between 2022 and early 2025. At the same time, strategic divestments are another active part of strengthening Safran’s core businesses.

The Defense & Aerospace Companies Briefing includes coverage of major global competitors. Each report addresses key events, strategic initiatives, segment performance, product development, contracts, partnerships, acquisitions, restructurings, finances and more.

To inquire about subscribing, visit Defense & Aerospace Company Briefing

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591