14 September 2022

Raytheon Technologies Corp.

Raytheon Technologies was created in April 2020 by the merger of Raytheon Co. and United Technologies. The global COVID pandemic and its effects, including reduced commercial aircraft demand, supply chain disruptions and cost pressures, have limited an early assessment of how the merger is meeting management’s originally stated objectives.

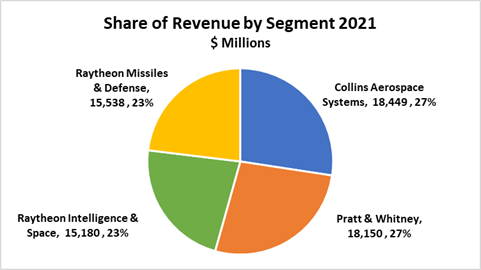

- For the full year 2021, Raytheon Technologies had total revenues of $64.388 billion. It should be noted that this figure is well below the stated pro forma 2019 revenue of $74 billion. Operating profit of $4.958 billion was reported for 2021. Financials for 2020 are not comparable because they only reflect the period after the merger in April of that year.

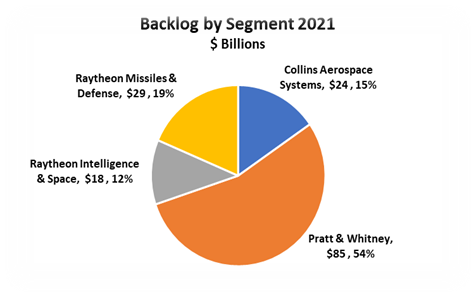

- Backlog for the entire company was $156 billion at the end of 2021, almost 2.5 times its annual revenue. In 2022, the backlog was $150 billion.

- Pratt & Whitney reported $18.150 billion of revenue for its first full year as part of Raytheon Technologies. This was up 8% from $16.799 billion in 2021. (Pratt & Whitney and Collins Aerospace are fully comparable for 2021 and 2020, because unlike the RIS and RMD segments it has a full year of financial performance reported for 2020.) In 2021, Pratt & Whitney reported operating profits of $454 million, or an operating profit margin of 3%. This was up from 2020 when the segment reported an operating loss of $564 million.

- Collins Aerospace Systems reported $18.449 billion of revenue for its first full year as part of Raytheon Technologies. This was down 4% from $19.288 billion in 2020. In 2021, Collins Aerospace reported operating profits of $1.759 billion, or an operating profit margin of 10%. This was up from 2020 when the segment reported an operating profit of $1.466 billion.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591