16 August 2022

Airbus vs Boeing: Comparing Forecasts

The biennial Farnborough and Paris air shows are usually the cue civil aircraft manufacturers use to issue their prognostications about the future of the commercial aviation business. And right on cue, Airbus, Boeing, Embraer, and ATR all issued their own takes on what was going to happen in the future. It is worth noting that these documents are something of PR exercises aimed at various audiences from suppliers to investors, but from our experience with the people behind them, there is still a respectable amount of vigor that goes into making them. And while there are differences in each of these, usually skewed to their product lines, there is a reasonable amount of consensus amongst the players as to how they see the world.

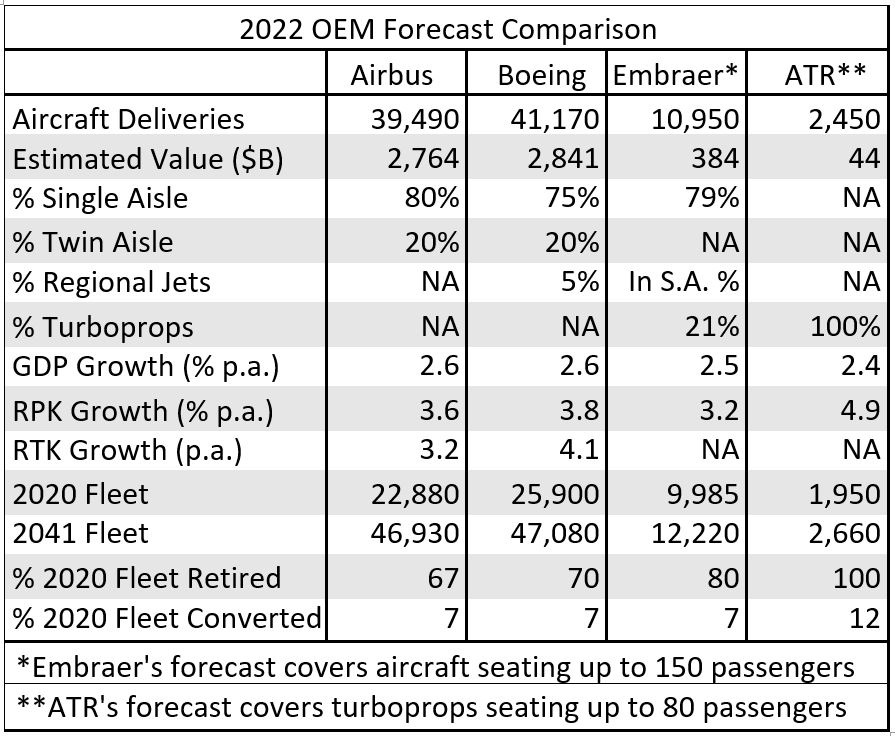

We will not bore you with the numbers here (see chart below), but it is interesting to note just how much consensus there is. Average annual world GDP growth is a relatively narrow 2.4%-2.6%. Average annual traffic growth (in RPKs) ranges from 3.2% (Embraer) to 4.9% (ATR), with Airbus and Boeing in the middle at 3.6% and 3.8% respectively (the ATR figure applies only to a narrow group of routes under 900 nm and 300 daily passengers each way).

Airbus and Boeing cover most of the same landscape with the difference that Boeing includes regional jets and Airbus does not. If you strip out the regional jet deliveries in the Boeing forecast, then Boeing’s and Airbus’s delivery numbers are almost the same at around 39,000 and 39,500 respectively. Some of the difference can be chalked up to a slightly higher allocation of single aisles by Airbus (80%) compared to Boeing (75%). Both Airbus and Boeing expect around two-thirds of the current passenger fleet will be retired, and another seven percent will be converted to freighters. Airbus expects the 2041 fleet of aircraft to total 46,930 compared to Boeing’s 44,740 figure (RJs excluded), which, again, reflects Airbus’s broader single aisle product line.

ATR’s and Embraer’s forecasts are more nichey, and are thus harder to compare, but the two do overlap on turboprops. ATR thinks 2,450 turboprops will be delivered over the next 20 years while Embraer thinks the number will be 2,280 which is only a 170 difference, or only 81/2 per year over the 20 years.

The other part of Embraer’s forecast is the under 150 seat jet segment, reflecting its current E-Jet products. Embraer doesn’t break down its sub-150 jet category and neither do Airbus nor Boeing break down their single aisle categories, so we can’t compare Embraer’s 8,670 expected sub-150 seat delivery number. It’s a bit of a mash up, but if you subtract Boeing’s RJ forecasted deliveries (2,120) from Embraer’s under 150 seat number that suggests that Embraer split is roughly 25% RJ and 75% 100-150 seaters.

One detail that all the manufacturers have decided to omit is the value of their deliveries. Perhaps they all finally realized that quoting values based on list prices was meaningless since almost every commercial jet actually sells for a deep discount over list. But we are here to help. Based on our own research and analysis we have estimated the value in 2022 dollars of these forecasted deliveries in the chart below.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591